London and Surrey Property Market Outlook 2026

The London and Home Counties residential property market enters 2026 on firmer footing after several years of disruption. Rather than a sharp rebound or renewed decline, consensus among lenders, analysts, and property consultancies points towards measured growth, regional divergence, and a renewed focus on fundamentals. For homebuyers and residential investors—particularly in Surrey—2026 is likely to reward preparation, realism, and selectivity.

Price outlook: steady, not spectacular

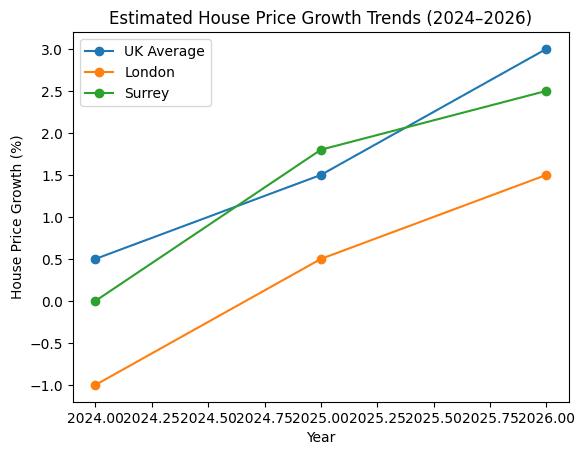

Most major forecasters expect UK house prices to rise by approximately 2–4% in 2026. Nationwide and Halifax both point to modest growth supported by easing mortgage rates and wages beginning to outpace inflation. Savills forecasts around 2% national growth, while Knight Frank places the figure closer to 3%.

However, the picture differs regionally. London and the wider South East are expected to underperform the UK average, largely due to affordability constraints. London house prices have underperformed for nearly a decade, with values flat or falling in real terms. Savills and Knight Frank both expect London growth of around 1–2% in 2026, with flats continuing to lag houses.

Surrey, while technically part of the South East, is better positioned. Structural demand for space, strong schools, green surroundings, and rail connectivity means Surrey is likely to outperform much of London, particularly for family housing.

Chart 1 illustrates expected house price growth trends between 2024 and 2026, showing Surrey consistently outperforming London, though still below the national average.

Supply and demand: different pressures, similar constraints

London currently offers buyers greater choice, especially in the new-build flat sector. However, this masks a longer-term risk: housing delivery in London has fallen sharply below required levels. According to Knight Frank, new housing starts are running so low that London is likely to face one of its most supply-constrained markets of the past decade by the late 2020s. While 2026 remains relatively balanced, underbuilding today points to future upward pressure on prices.

Surrey faces the opposite problem. Demand remains resilient while supply is structurally constrained by greenbelt policy and planning resistance. Although competition has cooled from pandemic highs, well-priced homes in commuter towns continue to attract strong interest. Family houses outperform flats, and turnkey properties sell faster than renovation projects.

Economic backdrop: easing pressure, improving affordability

The macroeconomic environment is more supportive than in recent years. Inflation is forecast to fall towards 2–3% by late 2026, while the Bank of England is expected to reduce the base rate into the low-3% range. Mortgage rates have already eased, improving affordability at the margin.

Wage growth is expected to remain positive in real terms, though affordability in London and Surrey will remain stretched. As a result, price growth is likely to stay modest rather than accelerate.

Policy and taxation: headwinds remain

The reversion of stamp duty thresholds in April 2025 has increased transaction costs, particularly in higher-priced regions. First-time buyer relief is less generous, and investors now face a 5% stamp duty surcharge on additional properties, alongside higher effective taxation on rental income.

These changes have reduced buy-to-let activity among smaller landlords, though strong rental demand and limited supply continue to support rents—especially in Surrey commuter hubs.

Remote working and infrastructure: Surrey’s structural advantage

Hybrid working remains embedded, sustaining demand in commuter counties. Over half of Surrey buyers work in London but no longer commute daily. Homes offering space for home offices and proximity to rail stations remain highly sought after.

Infrastructure investment reinforces this trend. Rail upgrades on the North Downs Line and wider planning reforms encouraging development around transport hubs are likely to benefit select Surrey towns over the medium term.

Surrey hotspots to watch

Guildford – Strong commuter appeal, university-driven rental demand, and major regeneration.

Woking – Excellent rail links, improving town centre, and comparatively strong yields.

Elmbridge (Cobham, Weybridge, Esher) – Prime family markets with limited supply.

Reigate, Epsom, Farnham – Lifestyle-driven demand with relative value compared to west Surrey.

Conclusion

In 2026, London and Surrey are likely to see stable but selective growth. Surrey’s chronic undersupply, commuter demand, and lifestyle appeal place it in a stronger position than much of London. Buyers benefit from improving affordability without runaway prices, while investors must focus on quality assets rather than leverage-driven returns.

References & Endnotes

Nationwide Building Society, UK Housing Market Outlook, 2025–2026

Halifax House Price Index, Annual Forecast Commentary, 2025

Savills Research, UK Residential Market Forecasts, November 2025

Knight Frank Research, UK House Price & Rental Forecasts, 2024–2026

Office for National Statistics (ONS), CPI and Earnings Data, 2024–2025

HM Land Registry, UK House Price Index, England & Wales

The Guardian, UK House Prices Forecast to Rise Up to 4% in 2026, Dec 2025

UK Government, Stamp Duty Land Tax: Residential Rates, GOV.UK

Network Rail, North Downs Line Upgrade Programme, 2025

Rightmove, Housing Market Outlook, Q4 2025